Financial results of the Budimex Group after six months of 2021 – commentary by Artur Popko – President of the Management Board of Budimex

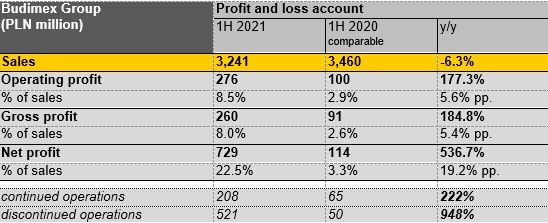

'We are very pleased with the results of the Budimex Group in the first half of 2021. Despite difficult market conditions, we recorded a significant increase in the Group’s gross profit within continuing operations (i.e. construction and service operations) from PLN 91 million in the first half of 2020 to PLN 260 million in the first half of 2021 with a simultaneous increase in profitability from 2.6% to 8.0%' – says Artur Popko – President of the Management Board of Budimex SA.

Such a good result is the effect of the improvement in the result of the construction and service parts as well as the settlement of the result from transactions between the construction and development segments in the amount of PLN 68 million resulting from the sale of Budimex Nieruchomości. The transaction finalised at the end of May completes the process of the review of the strategic options of the development segment in the Budimex Group. The final sale price did not change in comparison with the original assumptions and the total impact of the transaction on the Group’s net profit amounted to PLN 542 million.

We recorded a small drop in the Group's revenue on sales, with revenue in the service segment growing by 29.9% and in the construction segment dropping by 10.4%.

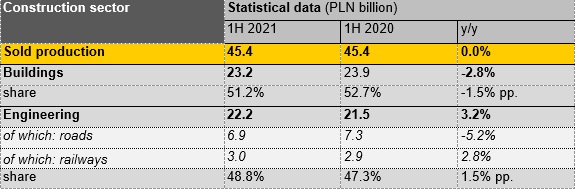

In the first half of 2021, the construction and assembly production (in current prices) amounted to PLN 45.4 billion and was at the level of the previous year. In the segment of buildings, the sold production decreased by 2.8%, with an increase in the area of residential buildings by 3.8%, and a decrease in the area of non-residential buildings by 6.7%. In the infrastructural area, the construction and assembly production increased by 3.2%.

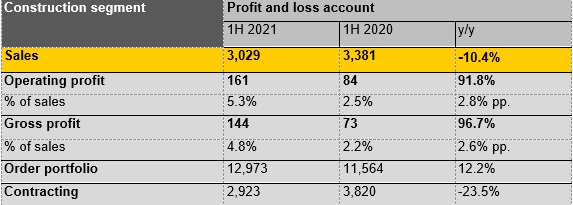

The sales of the Budimex Group’s construction segment was PLN 3,029 million (-10.4% y/y), with a significant improvement in profitability.

The scale of sales revenue in the first half of the year is slightly lower than in the corresponding period of the previous year, and the dynamics of the decrease is below the market indicator. It results from the fact that several material orders from the road construction area are now at the design phase or we are waiting for permission to be issued for the implementation of a road investment. The result is that production within these contracts is relatively low. Moreover, we observe a decrease in volumes in the general construction segment, in which – taking into account the current portfolio and contracts awaiting signing – we expect increases in the second half of the year.

The gross profitability of the construction segment amounted to 4.8% and was noticeably higher than in the first half of 2020, when it amounted to 2.2%. We are experiencing a significant increase in the prices of materials. However, due to partial indexation mechanisms, our policy of securing prices of key ranges and a careful approach to tender procedures, we are able to maintain the originally planned contract margins in the case of most projects. Additionally, due to the completion of difficult power engineering contracts, we assume the maintenance of good profitability of the order portfolio for at least several quarters.

In the first half of 2021, we obtained contracts of PLN 2,923 million, while we have further orders of the value of PLN 3 billion awaiting signing. It is a lower level than one year ago, but our priority is, invariably, to take care of the profitability of the order portfolio. The largest projects which we hope to sign include the Białystok-Ełk E75 railway line (PLN 587 million, selection of the most favourable bid) and the Leśnice-Bożepole Wielkie S6 expressway (PLN 584 million, selection of the most favourable bid).

In the last few days, we signed a contract for the Construction of the Frito Lay Plant in Poland with the value of PLN 343 million, which is important for the large-volume construction segment and will allow us to fully use our capabilities in this area.

At the end of June 2021, the value of the order portfolio reached PLN 12,973 million. This level gives us operational comfort and ensures that this year we will fully utilise our resources. After taking into account contracts which we are planning to sign during the upcoming months, our scope of works is secured until the end of 2022. Due to this, we are taking a selective approach to new offers, calculating cost estimates thoroughly and responsibly, in particular in the environment of dynamically changing prices.

The Budimex Group ended the first half of 2021 with the net cash position at the level of PLN 2.8 billion. In June, for the 13th year in a row, we paid a dividend in the amount of PLN 426 million, which was PLN 16.70 per share. We are planning the payout of advances towards the dividend for 2021. The unit net profit of Budimex SA for the first half was PLN 762 million. We intend to pay out up to half of this amount, i.e. no more than PLN 381 million.

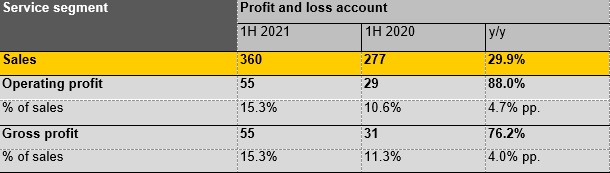

In the first half of 2021, the FBSerwis Group maintained upward trends significantly increasing sales revenue and gross profit.

The dynamics of sales revenue of the service segment amounted to 29.9%. The revenue of the FBSerwis Group, being the key asset in the area of services, was PLN 359 million and increased in comparison with the previous year by 29.8%. It results from larger volumes in the waste management segment. Gross profit was PLN 53 million versus the PLN 35 million in the first half of the previous year.

We are optimistic about the potential results and the development perspectives of the FBSerwis Group in the near future. The Group is systematically improving its profitability and increasing the level of sales revenue.

Our goal is for the FBSerwis Group to generate revenue of approx. PLN 1 billion by 2025, including those revenues through acquisitions. Currently, we are analysing a number of projects, mainly those increasing the company’s potential in the area of waste management. It is possible that by the end of this year, we will carry out one of such acquisitions.

We are entering the construction season with an order portfolio of PLN 13 billion and we are optimistic about the upcoming quarters. Analysing the current portfolio, orders which we hope to sign and our work schedule, we expect that the second half of the year will bring improvement in the annual dynamics of sales revenue. The future development of the pandemic and its impact on the functioning of the economy, including the availability of staff and the continuity of supplies, are still unknown. This is why we are closely monitoring the situation and verifying our operational assumptions on an ongoing basis. In the face of significant fluctuations in the prices of materials, we will focus on the control and optimisation of costs, which will allow us to minimise the impact of negative market factors and, as a consequence, to achieve profitability above market indicators.

The next quarters should also bring the intensification of tender procedures, in particular in the infrastructural segment. According to PKP PLK announcements, by the end of 2021 tenders valued at more than PLN 10 billion will be announced, and in the longer perspective, expenditure on the construction and modernisation of rail tracks are to reach approximately PLN 10 billion per year. For several years, the Budimex Group has been consistently building its position and competences in the area of railway contract performance. Due to the knowledge and experience achieved, we are currently ranked among the largest general contractors in this segment, achieving a nearly 20% share in the market of tenders for PKP PLK. In recent years, we have invested more than PLN 120 million in a modern track and traction equipment base, which allows us to effectively implement even the most demanding contracts.

The high balance of the cash position, taking into account funds obtained from the sale of Budimex Nieruchomości, encourages us to analyse the possibilities to enter into new projects, including projects of photovoltaic and wind farms, where we have already obtained experience as a general contractor. We are analysing the first such projects, taking into consideration the required capital commitment, profitability, risks and potential synergies which they would contribute to the Budimex Group. We have consistently been working on acquiring the first contracts on neighbouring markets. We have already submitted the first offers. We primarily focus on road and railway contracts and have submitted offers first in Slovakia, the Czech Republic and Germany. Our purpose is to carry out investments with the value of several hundred million zloty per year, which will allow us to increase and, at the same time, to diversify our portfolio in the construction area.